Complete guide to workplace pensions

Everything you need to set up and successfully run your own auto-enrolment pension scheme.

Welcome

In this comprehensive guide, we’ll walk you through everything you need to set up and successfully run your own auto-enrolment pension scheme. We’ll also cover a few of the benefits of pensions, including how you can trim your company’s tax bill and help your employees keep more of their monthly earnings.

First a quick note. This guide will mainly focus on defined contribution pension schemes. For defined benefit schemes, we recommend speaking to your pension provider directly. Don’t worry if you aren’t sure if this affects you - we’ll go over the difference very shortly.

What is a Workplace pension?

At its most basic, a workplace pension is a pension arranged by you, the employer, for your employees.

In most instances, both you and the employee pay a portion of the employee’s salary into their pension, helping them save for later life. You may see this type of pension referred to as “occupational”’, “works”, “company”, “employer” or “work-based” pensions. They all mean the same thing. Since 2018, it has been a legal requirement for all companies in the UK to offer some form of pension scheme to all eligible employees.

How do workplace pensions work?

As an HR professional, it’s likely your responsibility to set up and help manage your workplace pension. You’ll need to choose a pension provider and make sure your company contributes a percentage of each employee’s salary into their pension every month.

Exactly how this works will depend on the type of scheme you offer. Let’s take a look at the different schemes available. Broadly speaking, there are two main types of employer pension scheme:

- Defined contribution (or “DC”)

- Defined benefit (sometimes called “final salary” or “DB”)

Defined contribution

If you’re looking to set up a workplace pension for your company, you’re most likely looking for a defined contribution scheme. This means you and your employees BOTH pay into their pension every month for as long as they’re employed.

Employee contributions will come straight from their salary - company contributions are also added before or after tax, depending on your scheme. Everything added to an employee’s savings pot will then be invested into a pension fund.

The pension fund invests their savings into financial markets - usually a mix of stocks and shares, government and corporate bonds, real estate and more. The value of an employee’s defined contribution pension comes from the total contributions how much you and your employer have paid as well as how well the pension fund has performed.

Defined benefit pensions

Some companies (particularly in the public sector) offer defined benefit pensions - also called a ‘final salary scheme’. Here, the size of an employee’s pension in retirement comes from their salary and how long they’ve worked for your company, among other things.

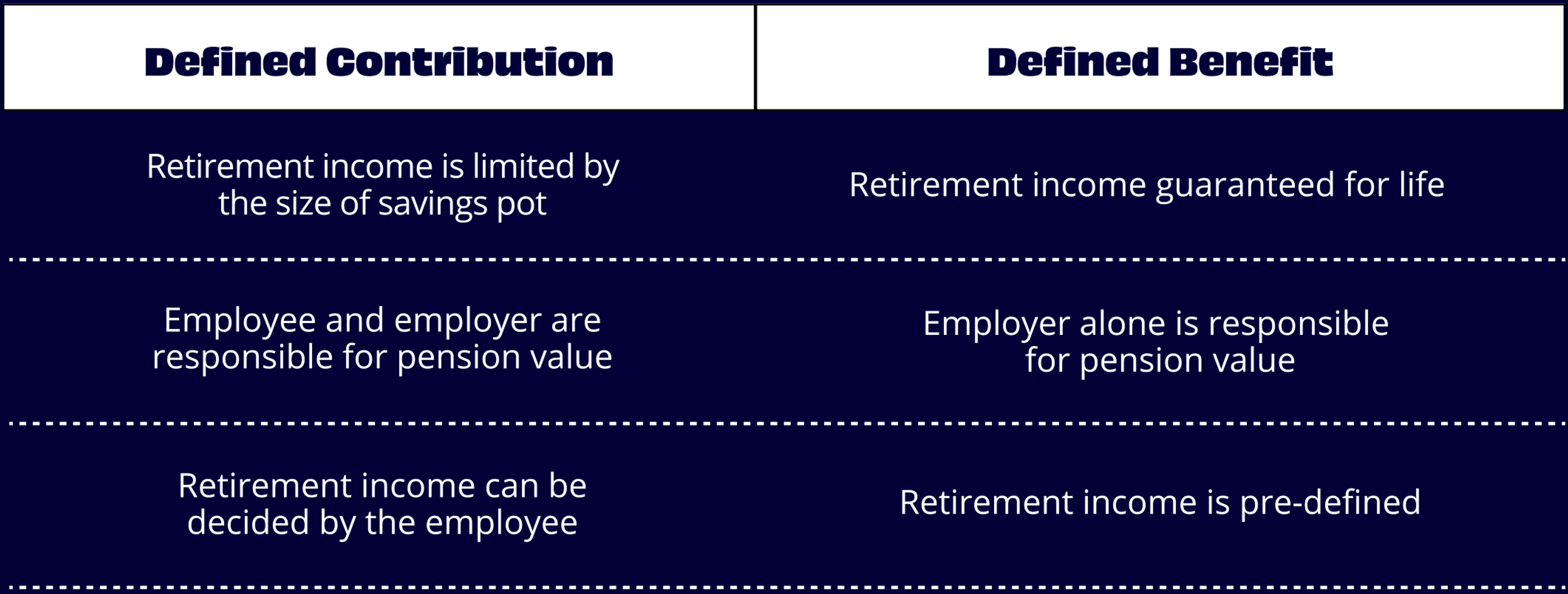

Defined benefit schemes are very expensive - as you are agreeing to pay a portion of an employee’s salary when they retire until they pass away. The table below summarises the differences between defined contribution and defined benefit pensions.

For help on setting up a defined benefit scheme, we recommend speaking to a pension provider directly.

What is auto-enrolment?

You may also see workplace pensions referred to as auto-enrolment. This simply refers to the fact that government legislation requires all eligible employees to take part (or ‘enrol’) in their company pension scheme automatically. If they don’t wish to take part, they’ll need to opt out manually. We’ll cover how this works in a later section.

Here’s the main takeaway: whenever you see auto-enrolment, just think workplace pension.

How much do UK companies need to contribute?

Right now in the UK, the minimum an employer needs to contribute to a workplace pension scheme is 3% of the employee’s pre-tax salary.

To qualify for this, the employee will normally need to contribute 5% of their pre-tax salary themselves. This is to reach the minimum legal pension contribution of 8% of an employee’s pensionable earnings. More on that very shortly.

What’s the maximum amount a company can contribute?

There is no upper cap on how much an employer can pay into their employees’ pension each month. Some employers offer to match employee contributions up to an agreed limit - for example, if an employee pays in 7% of their earnings each month, so will the company.

Ultimately, how much your company wishes to pay is up to you - just remember there are limits to how much pension tax relief is available. As of January 2022, each employee will only enjoy tax relief on the £40,000 of contributions (or 100% of their earnings, whichever is lower). Anything you add above this amount may be subject to tax.

What qualifies as pensionable earnings?

That 8% figure depends on how you work out an employee’s ‘pensionable earnings’. Whichever method you decide to use, it’s important to make it clear to your employees via their pension documentation. There are three ways to approach pensionable earnings:

1. Basic pay

The easiest way to calculate pensionable earnings is the "Basic Pay" approach. Here, you'll use an employee's salary BEFORE any added commission or bonuses.

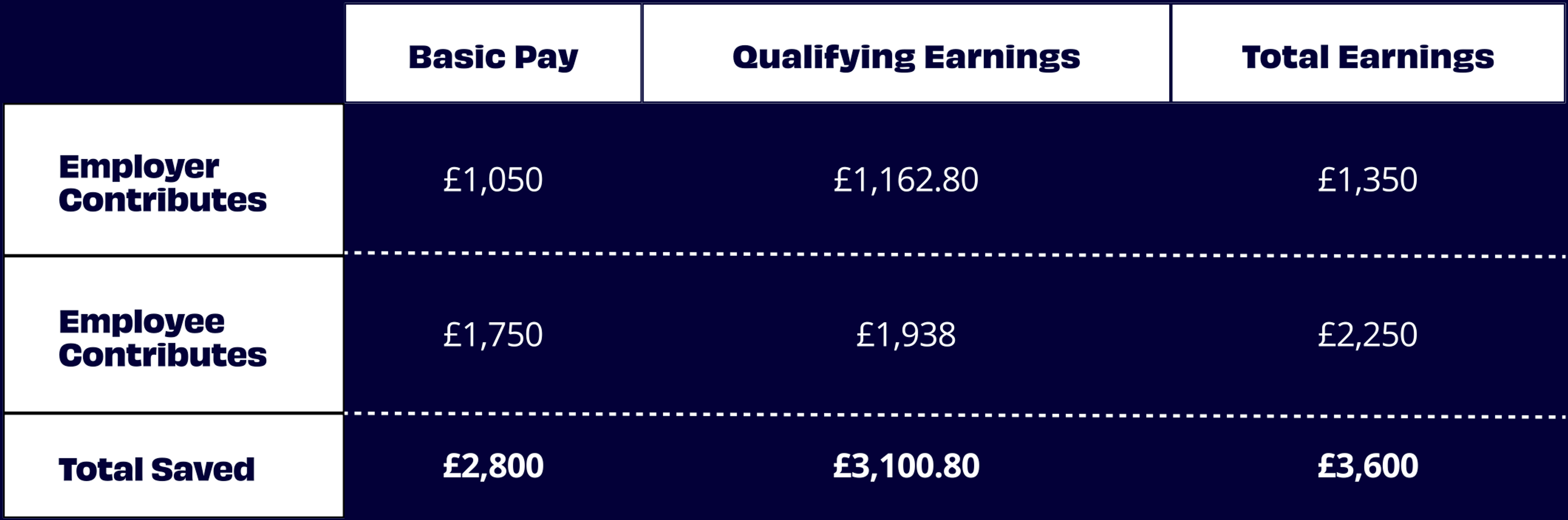

For example, if an employee earns £35,000 yearly basic but receives £10,000 in bonuses, only the £35,000 salary counts as pensionable earnings. Together, you and the employee will need to contribute a minimum of 8% of their annual salary. In our example, that means your company must pay in £1,050 a year.

2. Qualifying earnings

Another way of calculating pensionable pay is something called "qualifying earnings". In this approach, you'll use any earnings between £6,240 and £50,270 as the basis for contributions. This also includes:

- Bonuses

- Commissions

- Overtime

- Statutory sick pay

- Maternity/Paternity pay

- Adoption pay

- Holiday pay

Using the same employee earning £35,000 (with a £10,000 bonus) as above, your company will now need to contribute £1,162.80 over the year.

3. Total earnings

Finally, you can also use an employee's total earnings as the basis for their pensionable earnings. This is simply their basic pay plus all the extras outlined above. Again, for our worker earnings £35,000 a year with a £10,000 bonus, your company would have to contribute £1,350 into their pension.

Here’s how that all compares for an employee earning £35,000 with a £10,000 annual bonus.

Do I need to enrol every employee?

By law, you are only required to enrol 'eligible employees' in your workplace pension scheme. An eligible employee means:

- They are legally classed as a 'worker' (see the government's guidelines at gov.uk/employment-status/worker)

- They are aged between 22 and State Pension age (currently 66)

- They earn at least £10,000 per year (roughly £520 a month, £120 a week or £480 over 4 weeks)

- They work in the UK

Additionally, there are a few other things that may disqualify an employee from your pension scheme. These include:

- They've given (or received) notice that they're leaving their job

- They've already taken out a pension that meets the automatic enrolment rules

- They previously opted out of your pension scheme within the last 12 months

- They're part of a limited liability partnership

They're a company director without an employment contract employing at least one other person

Can employees opt out?

While every eligible employee needs to be enrolled automatically in your workplace pension scheme, they can 'opt out' if they don't want to take part. They can do this by sending you a formal opt-out request by letter or email.

If they have been paying into your pension scheme previously, their savings pot will remain where it is until they reach retirement age, or decide to transfer to a new pension provider. The company will no longer need to contribute into their pension pot unless they choose to opt back in.

It's important to know that even if an employee has opted out, you as the employer legally must offer them the chance to rejoin the scheme at least once a year.

Further, you'll need to automatically re-enrol them back into the company pension scheme after three years (assuming they are still eligible). If the employee still does not wish to take part, they'll need to manually opt-out again.

Contributing to a Workplace Pension

When you contribute to an employee's pension, both the company and your employees benefit from tax relief on contributions.

How this works (and how much tax you'll save) depends on how you decide to process your contributions. You have three options for arranging pension contributions:

- Before tax (known as 'Net Pay')

- After tax (known as 'Relief At Source')

- Salary sacrifice

It's up to you to decide which method you prefer. In the next section, we'll outline how each of these approaches works.

Net pay

With Net Pay, you'll take out your employee's pension contribution from their monthly wage before they pay any tax. When you run payroll, each employee will receive their regular monthly salary minus their desired pension contribution. You'll add your company's contribution separately. This will show up on their payslip as 'Employer Pension' or 'ER Pension'

This portion of their earnings will go directly into their pension, meaning it won't be subject to Income Tax or National Insurance. The figure they see on their payslip will include tax relief from the government.

It happens automatically and your pension provider will claim tax relief from the government on your behalf - you won't have to do this yourself. Basic, higher or additional taxpayers will save tax at their marginal rate. The only downside is that any employees that don't pay income tax won't get any tax relief on their contributions.

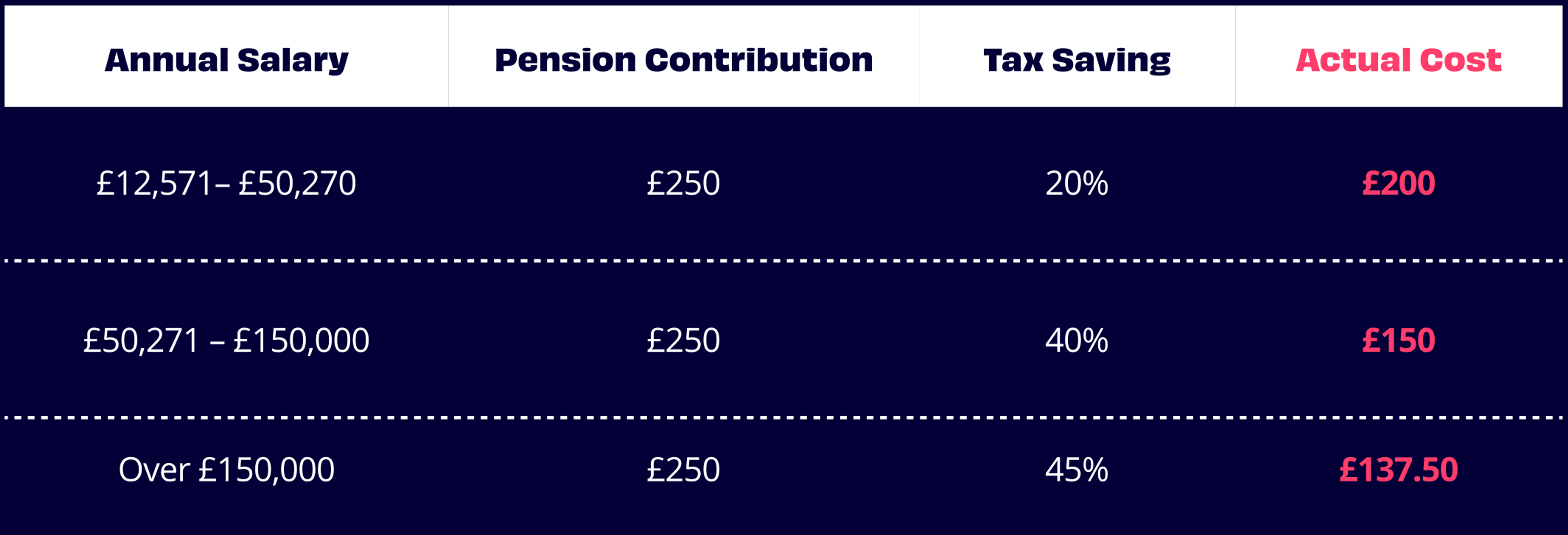

Here’s what that looks like for a £250 contribution.

The Net Pay approach reduces your employee's overall take-home pay, reducing the amount they owe in tax. Essentially, they get to keep more of the money they've earned.

Relief at source

Relief at Source means pension contributions are taken out of an employee's salary AFTER they've paid tax on their earnings.

Here's how it works. First, income tax and National Insurance will be deducted from the employee's salary as normal. You will then take the employee's pension contributions from their pay before it arrives in their bank account. After tax, but before it reaches your team. Again, contributions from your company happen separately. Your pension provider will then claim tax relief back from the government at the basic rate.

For anyone earning under £50,270, that means they'll save 20% tax on everything they pay in. It's worth noting that employees won't receive any tax relief on the employer contribution - more on this later. This automatic tax relief applies even to those who don't pay any income tax - making it a fantastic way to boost pension savings.

Let's say you want to add £100 into your pot. £80 will come from their salary, with the remaining £20 coming from the government as a tax top-up. Higher earners can claim even more back - but will need to do this themselves via a self-assessment tax return.

One more benefit is that any extra tax relief claimed from their tax return doesn't have to go into their pension. It can simply be removed from their tax bill or even taken as a tax rebate.

Salary sacrifice

One final type of pension arrangement available is salary sacrifice. This is a government-backed scheme where employees can swap part of their salary for regular pension contributions. Instead of employees paying into their pension from their monthly earnings, the entire pension contribution will come from you, the employer.

They voluntarily 'sacrifice' a portion of their earnings, reducing their overall salary in favour of having more money in their pension. Essentially, this works the same way as the Net Pay approach with one key difference - the employee technically isn't contributing to their pension themselves. This also helps save on National Insurance.

Workplace pension tax relief

Pension contributions don't just help employees pay less tax. They also benefit the employer.

Employer contributions are an allowable business expense that can be deducted from any profit your company makes. This means that despite being a legal requirement, you can use pension contributions to reduce your company's profit and pay less corporation tax.

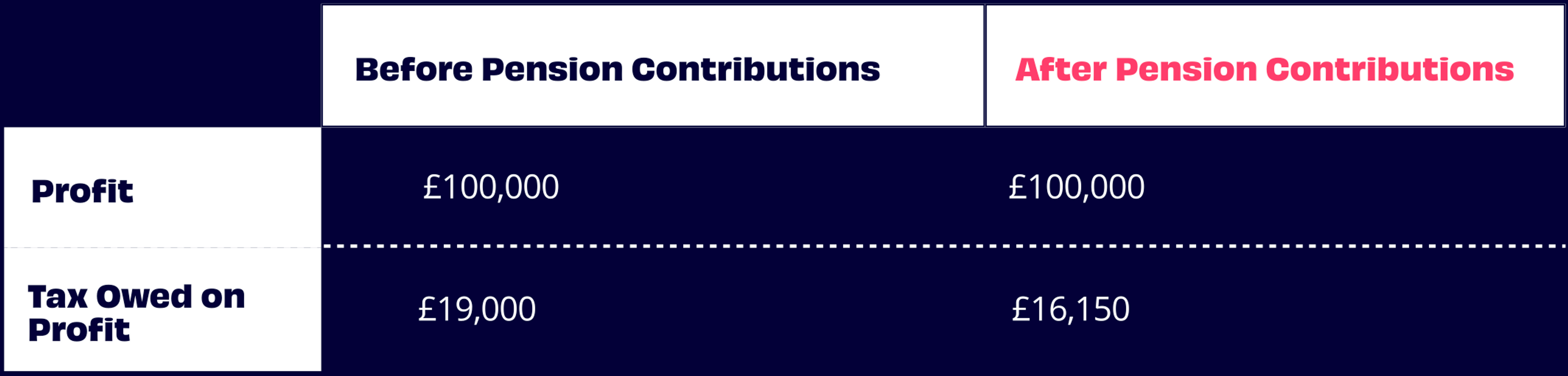

Let's say your company accounts show £100,000 profit for their year. Normally, your employer would owe 19% corporation tax on that figure - totalling £19,000. If your company contributions total £15,000 for the year. You can add this as an expense, meaning you'll now only owe £16,150 on your £100,000 profit. Just by deducting your pension contributions, you've saved £2,850 on your tax bill.

Another way to maximise tax relief from your workplace pension is by setting up a salary sacrifice scheme as outlined earlier. As the entire pension contribution comes from the company, you’ll benefit from more tax relief on National Insurance per employee. You’re contributing more, so you’re saving more.

How to set up a Workplace pension

Ok, now we know more about how workplace pensions work, you're ready to organise your own pension scheme.

How do you actually go about setting up a workplace pension for your employer?

1. Pick your pension provider. First of all, you'll need to choose your workplace pension provider. This is a third party company that will manage your pension for you. They'll collect all your company pension contributions and make sure each employee's savings are invested in line with their wishes. They'll also help your employee with pension withdrawal when they reach retirement age.

2. List your eligible employees. Next up, you'll need to work out who you're going to enrol. Using this guide as well as resources from the government, you can filter your workforce so you know who you'll need to add to your pension scheme. Save the list and send it to your new provider.

3. Let your team know. Once your pension scheme is ready to go, you'll need to let your employees know the details, including:

- How much you'll contribute

- How much they'll need to contribute

- How to opt-out

Your pension provider should be able to help with this.

4. Declare your compliance. Finally, you'll need to let the Pensions Regulator know your auto-enrolment scheme is fully compliant. Again, your pension provider should lend a hand but it's your responsibility to send your declaration of compliance within five months. If not, you could face a fine.

If you're still unsure about how to get started or have any questions, we'd love to help. Request information and we'll be more than happy to help you get your scheme up and running.

Join Penfold and bring financial wellbeing to your team

Give your team a top pension and boost their financial wellbeing

Boost your benefits package to keep and tempt the best talent

Get industry-beating account management at no extra charge