Four minutes

Pension performance update: June 2023

How did your pension fund do in June? US markets were the ones to watch.

The warmest June on record also saw the stock market heating up, with global equities rising by almost 6% during the month. It was a big improvement on May, which saw falls of 1.2%.

Tech stocks like Microsoft and Google fuelled this rise, as investors continued to be excited by the prospects of artificial intelligence.

Remember, pensions need time to grow, and short-term market swings are a part of that journey. The ups and downs help your savings grow long-term.

Let’s explore why these swings happen whilst keeping in mind that, historically, markets have always bounced back to keep growing.

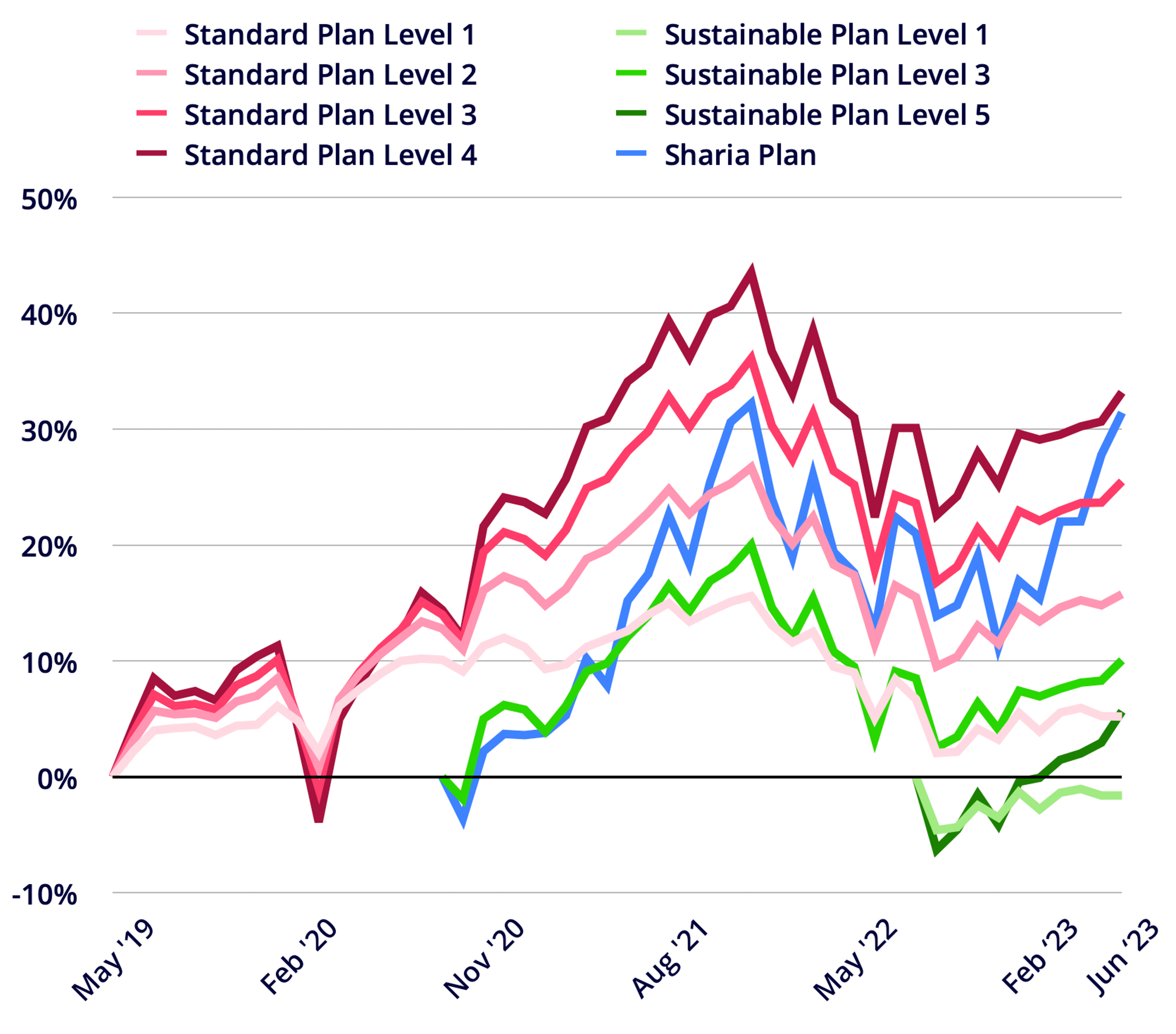

How our pension plans performed

The strong performance of stocks and shares globally in June meant our pension plans performed very well, with all of them either holding onto or beating the gains made in May.

Our sustainable funds did particularly well, with one of those plans notching up an impressive three percentage point increase on the previous month.

Penfold's diversified portfolios allow for this success, decreasing risk, limiting potential losses, and enhancing investment performance.

This approach is particularly valuable during challenging market conditions, as a well-diversified portfolio is more likely to withstand market fluctuations and deliver more stable returns over time.

US sees big bounce

The US market was the outstanding performer in June, with the bank related turmoil witnessed in March and April as a result of the collapse of California-based Silicon Valley Bank now taking a back seat to more positive news.

The result was an astonishing increase of 6% for the S&P 500, which tracks the performance of the biggest 500 companies in the US. It was the biggest monthly climb since October last year.

To put the gains into perspective the S&P 500 only managed a modest increase of 0.25% in May, and so the rise in June was significant.

Much of the increase was again down to the performance of the technology sector as excitement around harnessing the benefits of artificial intelligence continued to dominate.

Investors have been searching high and low for companies best placed to take advantage of that surge in interest, so guess which tech companies benefited? Yep, you guessed it: Microsoft, Facebook owner Meta, and Alphabet (the parent company of Google) have all seen their share prices soar this year.

Investors were also buoyed by data coming out of the US that showed inflation could be finally being brought under control.

Spiralling prices meant the Federal Reserve, the central bank in the US, had increased interest rates 10 times in 14 months in a bid to dampen inflation.

However, the Fed paused its cycle of rate hikes in June, which is seen as a positive move for the growth of the economy, the share prices of companies and hence the performance of your pension plan.

The Fed has suggested there may be a couple more interest rate rises to come this year but the temporary halt in June was well received.

As a reminder, while it's helpful to stay informed with the latest news, the S&P 500's 30-year rise shows that long-term growth, not short-term fluctuations, is the thing to focus on when accumulating pension wealth.

UK: sticky inflation keeps FTSE flat

While the US stock market had a stellar month, the performance of the UK was muted by comparison.

The FTSE 100, which tracks the performance of the biggest 100 companies in the UK, finished the month basically flat, with investors worried about rising inflation and further interest rate increases from the Bank of England.

While the Fed in the US chose to pause its cycle of interest rate hikes in June, the Bank of England surprised investors by increasing rates by half a percentage point to 5% – the highest it’s been since 2008.

Not only do rising interest rates suck money out of the economy but they are particularly bad for companies – the country’s biggest house builders for example – who have been licking their wounds.

Rate rises lead to rising mortgage costs and falling house prices, which are bad news for them. The share prices of companies like Taylor Wimpey, Persimmon and Bellway have fallen by more than a third over the last year.

The increase in interest rates came after the UK's official inflation rate did not drop as expected in May, persisting at 8.7% - well above the Bank of England’s 2% target.

Economists and financial experts expect the Bank of England to now increase interest rates to 6% by the early part of next year and this has disappointed investors and dampened the performance of the FTSE 100.

In general, interest rate rises increase the cost of borrowing for companies, which in turn is typically bad for stock markets (and consequently the performance of your pension fund).

As the 30 year performance graph of the FTSE 100 above shows, it's the long-term trajectory that truly matters when it comes to building your pension pot, despite short-term changes.

EU: economies start to stabilise

After a fall in May, Eurozone stocks bounced back in June, with optimism returning within the trading bloc.

The strong performance in June meant that the pan-European Stoxx 600 index, which tracks the performance of 600 companies across Europe, returned almost 9% during the first six months of the year, despite previous turmoil related to the Silicon Valley Bank collapse and fears over rising interest rates.

Eurozone inflation was 5.5% in June according to preliminary data – far lower than analyst expectations. It’s now at its lowest since January last year but unfortunately remains well above the European Central Bank’s 2% target.

Despite the drop in inflation, the ECB did raise interest rates to their highest level in 22 years in June in a bid to meet the 2% target and has suggested that another rise will come in July – but the fall in inflation is encouraging and will be welcome news for investors.

Once inflation heads closer to the 2% target and the ECB is in a position to stop raising rates, and perhaps even start to decrease them, this will be positively perceived by investors and should have a positive impact on stock markets and the performance of your pension fund.

How are your other pensions doing?

It’s easy to check the performance of your Penfold pension any time you like, either online or through the app: just tap or click on ‘Your Plan’. But how are your other pensions doing?

If their performance is disappointing, you may want to consider transferring them to Penfold. It’s very straightforward and can be done whether you know all the details or not. Tell us what you know and we’ll track them down and transfer into your Penfold pension. For more details, click here.

With investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice and past performance is not a reliable indicator of future performance.

It is important to compare providers’ fees & any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. We cannot accept defined benefit pension transfers. If you decide to close your Penfold account and the value of your pot has gone down, the amount returned to the provider may be less than what you originally transferred.

Please know that if your employer is paying into your pension currently, transferring that pot may mean you lose out on their contribution. For more information on the risks see here.

Photo by Maxim Berg on Unsplash